Ensure compliance with identification requirements, FATF standards and your service policy to avoid penalties.

Receive comprehensive protection against all forms of fraud activities, personal information theft and document forgery.

Speed up income generation with quick KYB checks and focus on the secure growth of your business.

KYB Verification Steps

- Confirming EmailThe system asks a user to enter their email address to send a secret code. It is necessary to enter the code into the form to verify, monitor and create a secure channel for receiving notifications from the service.

- Providing Company DataThe user needs to fill out a specific form, providing the enterprise name, registration number, legal address and country.

- Submitting Registration DocumentsAt this stage, the user has to upload the company's registration documents, choosing from the options provided by the system. The documents should include the registration number, address, date of enterprise registration and beneficiary information.

- Providing Data About BeneficiariesUsing a special form, the user needs to provide information about beneficiaries: representatives, shareholders, directors (separately for each).

- Verifying Provided InformationThe system verifies the information using global databases and Artificial Intelligence technologies. The authenticity of the provided documents is also checked.

- Confirming CompanyUpon successful verification of all checks, the company receives confirmation in the form of a detailed report. Our tool is based on Artificial Intelligence and ensures a comprehensive, fast, and secure verification process with a high success rate.

Start using the UnitKYC services right now and discover how it will simplify your work

Key Stages of KYB Processes

Document Collection

The service gathers founding documents and bank statements, verifies bank accounts, confirms addresses, reviews tax declarations and credit bureau reports, UBO and other documents. This is important for reducing the risk of partnering with an organization that could involve your business in financial crimes and money laundering.

Analysis of Provided Information

By using data analysis technologies, you can minimize the risks of financial crimes and money laundering. It also helps enhance compliance with KYB requirements, providing corporate adaptation.

Data Management

Effectively manage KYC and KYB information as well as documents of your corporate client. You can use cutting-edge technologies or centralized systems to improve real-time checks and maintain regulatory compliance.

Easily Integrate Our Tools Into Your Workflow

With just one registration, you can start using our tool. The verification forms created by users can be viewed on any device. You can also customize it with your business's logo or slogan.

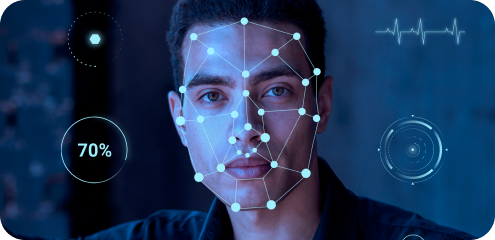

ID Verification

Make extensive automated identity verification checks online in a matter of seconds by using our service.

More details

Address Verification

Use our tool for address verification to ensure the accuracy of addresses entered by users, preventing fraudulent transactions.

More details

User Verification

Experience the benefits of digital identity verification in real-time and work only with identified users.

More details