Digital Identification – Your Way to Innovation, Growth and Trust

Customer identification issues are still present worldwide. Our service offers a holistic solution for automating the verification process online. We use AI and ensure global compliance with KYC and KYB requirements!

Products

Approach any verification challenge confidently

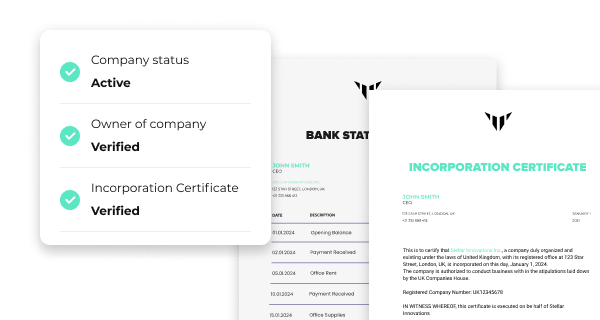

Business Verification (KYB)

Create forms for step-by-step business verification and automatically collect all the necessary data

Learn more

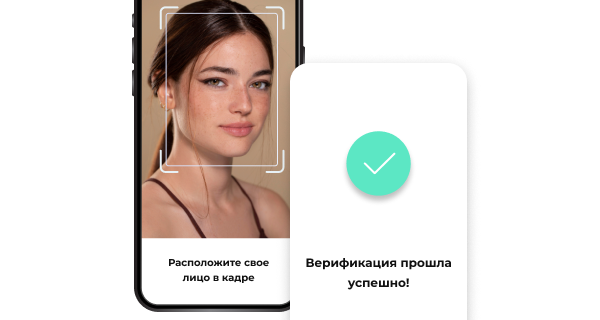

ID Verification

Verify users’ documents quickly and reliably by using AI technologies and advanced tools

Learn more

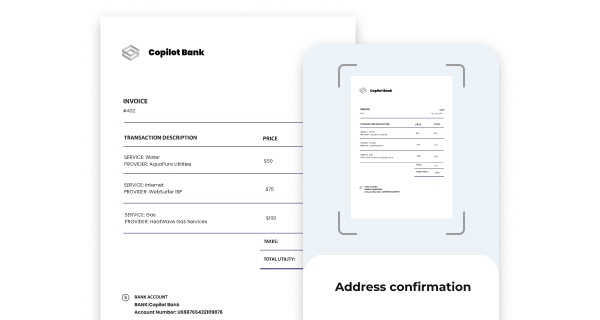

Proof of Address

Confirm customers’ addresses instantly by using customizable forms and automation tools

Learn moreIndustries

Get a turnkey solution for your business

Provide a Safe Experience for Users Across ID Stages

Identity validation, form processing, documents check, electronic signatures and beyond. Simply manage and direct your customers through automated processes and steps. No coding required — secure account creation and profile setup!

Reviews

See why 2000+ clients trust KYC

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galle

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of

FAQ

1 Why is KYC important for fintech?

KYC/AML for financial services is often mandatory as such businesses may face risks associated with illicit funds and transactions. Identity verification Fintech enables banks, platforms and applications to combat money laundering, terrorist financing and other criminal activities.

2 How do financial institutions verify identity?

3 What is a Fintech KYC solution?

4 What is transaction monitoring in fintech?

5 What is identity verification in fintech?

Contact Us

If you are interested in learning more about our services, please drop us a message and see how UnitKYC could help you! Our team would be happy to discuss your specific needs and guide you.